John Barone's Weekly Update

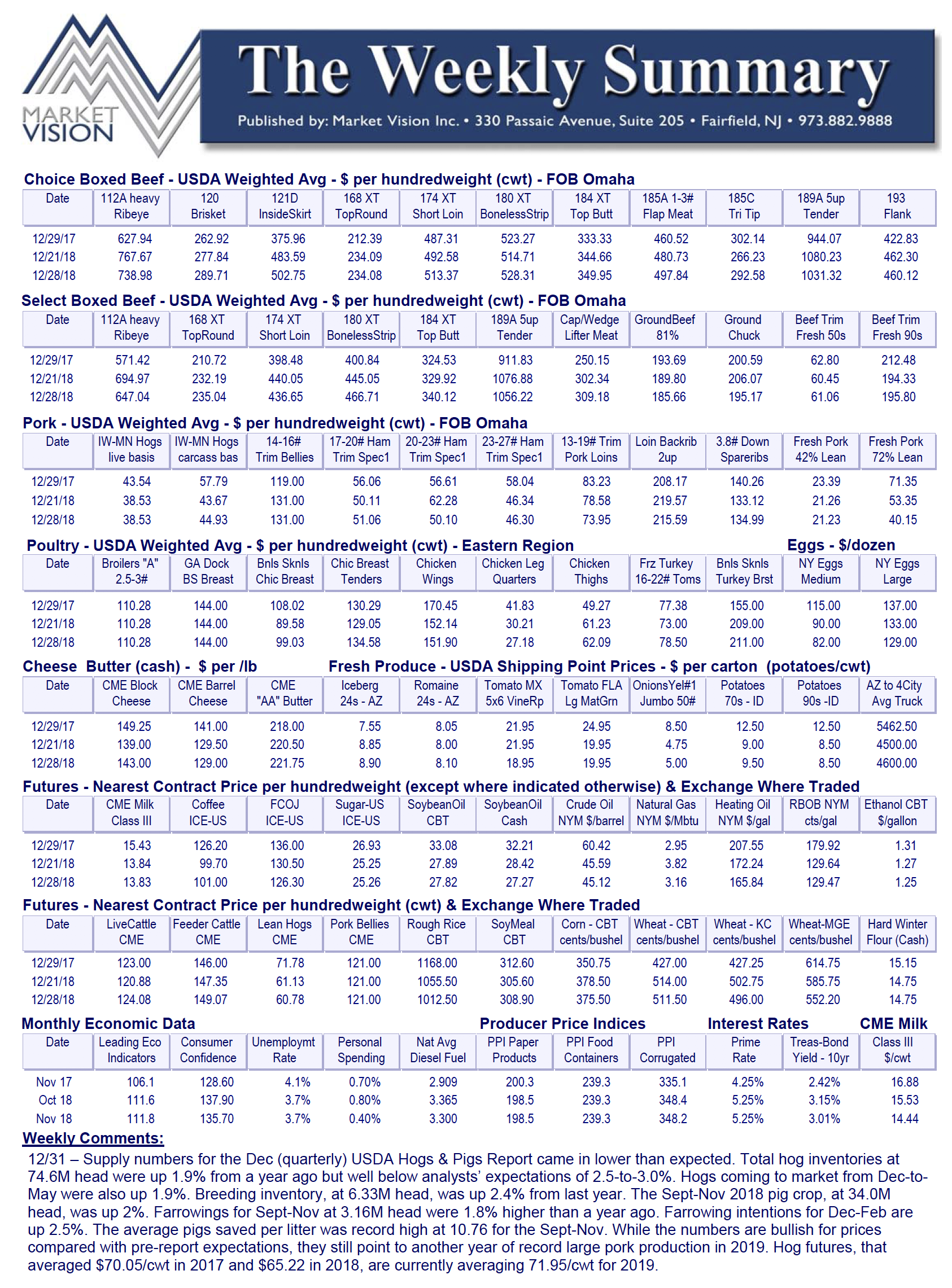

In Thursday’s cattle report, the USDA said feedlot inventories on April 1st were 11.83M head, down 1.6% from a year ago. New placements onto feedlots in March were down 5.2% from a year ago. The U.S. imported 1.2M head of feeder cattle from Mexico last year before imports were halted on Nov 25, 2024, due to “new world screwworm” disease.

Despite the 90-day reprieve on most reciprocal tariffs, the trade scenario has gone from bad to worse, given the 145% (as of 4/13) tariffs on Chinese imports and 125% Chinese tariffs on U.S. goods. The top 5 import categories from China in 2024 were:

The toughest thing about evaluating the new tariffs is trying to determine whether they are a temporary negotiating tool – or a more permanent revenue-raising strategy. The President is indicting both as tariff goals, so the effects might take a while to play out on a country-by-country basis.

In its quarterly report (3/27), the USDA said that U.S. inventories of hogs and pigs on March 1st (74.5M head) were down 1.7% from last quarter (12/1/24) and 0.2% below a year ago. Market-hog numbers were also down 0.2% from a year ago and the breeding herd was 0.6% lower.

Commodity Prices & Forecasts

Daily Price Reports – Meat, Poultry, Eggs

^TOP

^TOP