John Barone's Weekly Update

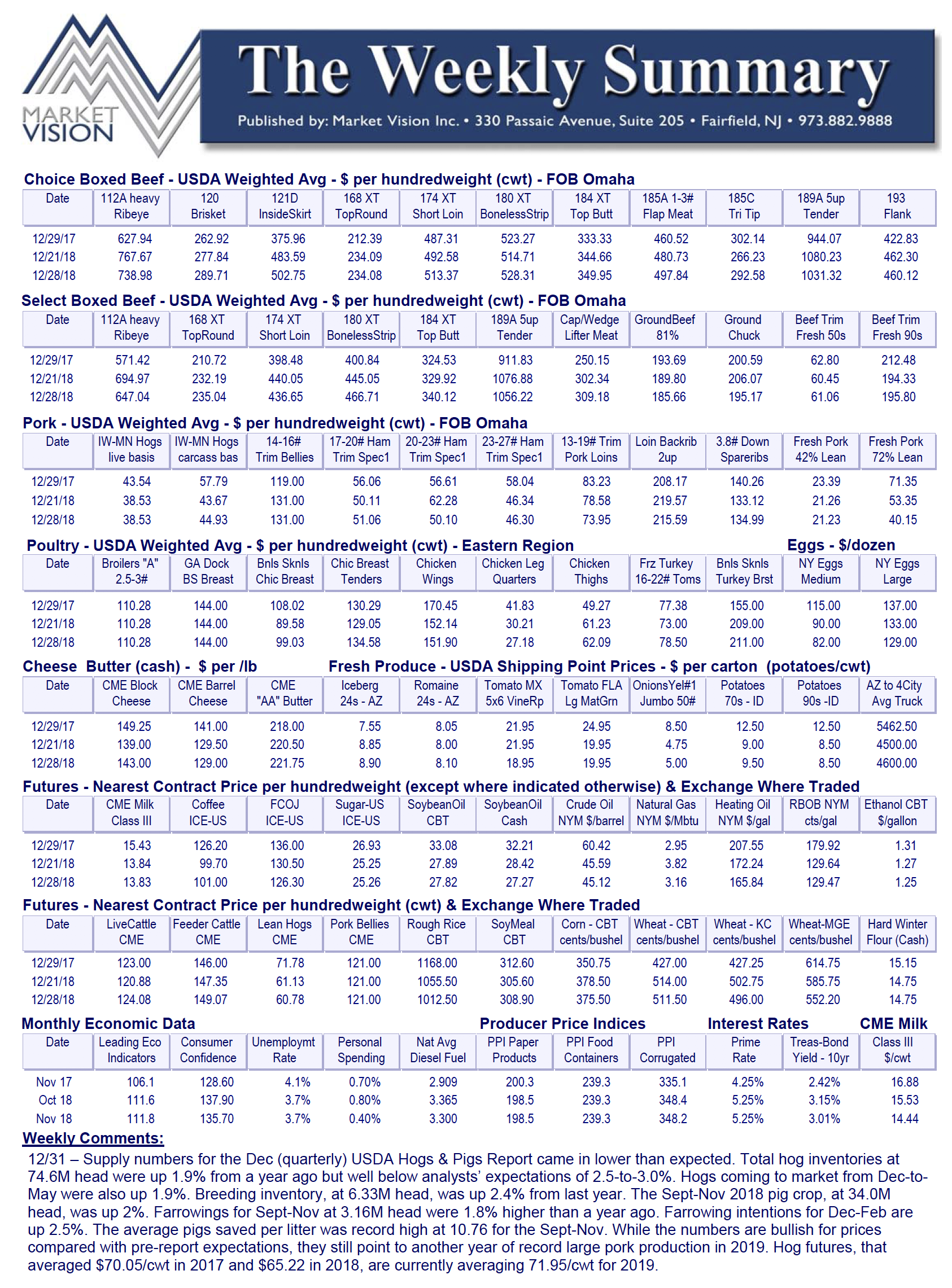

It’s a possibility that every other weekly commentary is going to be about beef for the rest of the year. The situation is that dire. The southern border is shut to Mexican cattle imports due to “New World Screwworm” disease.

In Friday’s monthly cattle report, USDA said feedlot inventories on Aug 1st were 10.92M head, down 1.6% from a year ago. New placements onto feedlots in July were down 6.1%. Mexican cattle imports have been mostly banned from entering the U.S. since Nov 2024 due to an outbreak of “new world screwworm” disease.

After peaking at 9% in June 2022 (CPI year-over-year), then falling to a low of 2.3% in April, inflation appears to be on the rise again. In last week’s CPI report, the July inflation rate for all goods was steady at 2.7%, while core CPI (excludes food & energy) jumped to 3.1%.

On Aug 6, the U.S. slapped 50% tariffs on Brazilian goods, including coffee. As a result, coffee futures, which hit all-time record highs of $4.32/lb this past Feb, then slumped to $2.80 in early July, are now back over $3 per pound ($3.09 on 8/8).

Commodity Prices & Forecasts

Daily Price Reports – Meat, Poultry, Eggs

^TOP

^TOP